Business

2021 Finance Bill to mandate Banks request Tax Identification Number from account holders

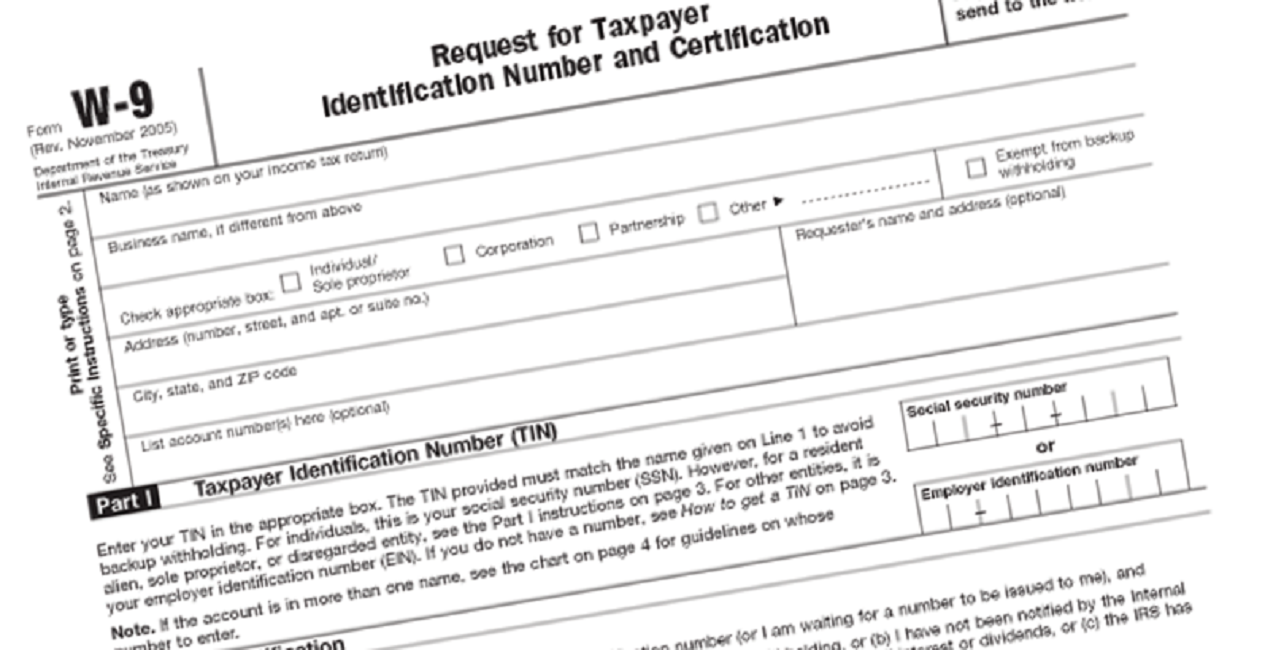

The 2021 Finance Bill will mandate banks to request a Tax Identification Number (TIN) before opening an account while “existing account holders must provide their TIN to continue operating their accounts”.

President Muhammadu Buhari had on Tuesday written the senate seeking the consideration and passage of a bill which he noted would guide the implementation of the 2022 budget.

While the cover letter was titled ‘Transmission of the Finance Bill 2020 to the National Assembly for Consideration and Passage into Law in Support of the 2021 Budget,’ the bill proposes various amendments to existing tax laws and financial regulations in response to the negative impact of the COVID-19 pandemic on the economy and the current recession.

ALSO READ: Buhari expected in Lagos Thursday for Bisi Akande’s book launch

In a lead debate, Senator Yahaya Abdullahi on Wednesday said; “Banks will be required to request for Tax Identification Number before opening bank accounts for individuals, while existing account holders must provide their TIN to continue operating their accounts”.

Abdullahi said, “This penalty is 10 per cent of the tax not deducted, plus interest at the prevailing monetary policy rate of the Central Bank of Nigeria.

“The conditions attached to tax exemption on gratuities have been removed.

“Therefore gratuities are unconditionally tax exempt.

“The duties currently performed by the Joint Tax Board as relates to administering the Personal Income Tax Act, will now be performed by the Federal Inland Revenue service.

“This seems to be an error in the process of amendments to replace the word “Board” as it appears in Federal Board of Inland Revenue.”