Opinion

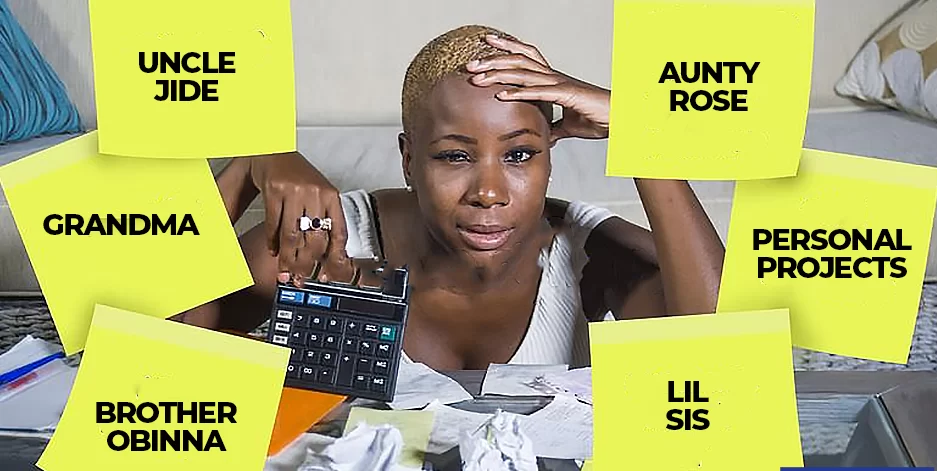

Cheta Nwanze: Black Tax and African Family Members Entitlement

By Cheta Nwanze

Dear reader, Happy New Year. I hope you had a restful holiday and crossover. Somehow, given what our country is going through, from the killings in the Middle Belt, to the rising tribalism, to the economy, things probably looked tough.

Like many in my circle, I have seen a sharp rise in people asking me for help, and to be honest, I need help myself as well. Things are that tough. Here is hoping that the worst of 2024 will be better than the best of 2023.

What prompted me to write this is the difference in the manner in which some of the people who asked me for holiday help made their requests. They fell into two broad groups, some were quite polite, and others were quite abrasive. Or entitled. There was one particular chap who clearly felt that just by asking, I had to drop whatever else I had planned and wire him cash, and this is dedicated to him, and people like him.

In a recent interview, John Mikel Obi, the former captain of the Nigerian Super Eagles, discussed various aspects of his football career, comprising his time at Chelsea, a thwarted transfer to Manchester United, and his experiences playing for the Nigerian senior national team.

Mikel’s discourse on the “black tax” phenomenon resonated deeply with a cross-section of the Nigerian middle class and has ignited a debate.

The term “black tax” originated in South Africa, denoting the financial support Black professionals and higher-income individuals provide to their parents, siblings and other family members.

A deep-seated sense of responsibility towards familial obligations often drives this financial assistance.

Mikel Obi, drawing from his personal experiences and those of fellow Nigerian footballers, vividly portrayed the considerable mental and financial strain imposed on those paying the ‘black tax.’

Mikel Obi articulated the challenges associated with the black tax, highlighting the burden of finding the balance between pursuing personal ambitions and satisfying financial demands that often come with a disturbing sense of entitlement.

He underscored instances where extended family members, who are previously unknown, often leverage familial connections for personal gain and selfish interests and even threaten the ‘payer’ when such tries to deny those requests.

He explained how some relatives feel their lives are sorted because of their affiliation with him, highlighting how some of them with large families implicitly designate him as the caretaker for their offspring. His experience bears similarities with that of the French football star Paul Pogba, whose family got him in legal trouble because of their avarice.

Mikel Obi’s interview shed light on the broader issue of entitlement, defined as the belief that one deserves special treatment or privileges without merit. If explained, the concept of “unmerited favour” often originates from a deficiency in empathy and an inadequate acknowledgement of the effort involved in acquiring the wealth that the recipient seeks to lay the metaphoric hands on.

Mikel Obi emphasised the emotional toll of constant financial demands and the reluctance to admit vulnerability, contributing to the perpetuation of entitled behaviour. Entitlement might arise from an unwillingness to acknowledge the need for assistance and a desire to uphold a sense of superiority. Delving into underlying emotions, such as shame and vulnerability, can offer insights into the behaviours associated with entitlement.

This entitlement can manifest when individuals exploit victimhood and poverty, presuming these conditions qualify them for unwarranted privileges. This tendency is common in societies that associate poverty with virtue; as such, societies tend to turn victimhood into a sought-after position, exemplified by the prevalence of beggars on Nigerian streets earning substantial amounts daily.

Often, entitlement manifests when a dedication to consumption exceeds one’s capacity for productivity. The imbalance between virtuous restraint and pronounced greed can lead to a tipping point. The persistence of this behaviour, regardless of its origin, is driven by the anticipation of some form of reward, making negative reinforcement a potential means for behavioural change. Usually, individuals may lack awareness of the emotional toll associated with giving, particularly when results are not evident. Thus, cultures that fail to cultivate empathy tend to experience higher incidences of entitled behaviour.

While acknowledging the negative aspects of entitlement, it is imperative to approach the discourse on black tax with nuance and balance. One must pay attention to instances where poor people have been helped to access lifesaving or life-changing resources such as education, healthcare, housing, or trade funding.

There have been notable instances of positive outcomes resulting from the Black Tax, indicating that the concept should not be dismissed outright. Black Tax extends beyond the exchange of money; it also involves the transfer of intangible resources such as skills and insights derived from successful professional and financial experiences. A good example in this context is the American billionaire Robert F Smith. He has generously contributed a substantial portion of his estimated $4.4 billion fortune to his community, including $34 million for student loan debt forgiveness. Many beneficiaries of his generosity have achieved remarkable feats, partly attributed to the alleviation of financial burdens he provided.

In Nigeria’s context, the prevalence of Black Tax reflects a distorted social contract, where responsibilities traditionally assigned to impersonal institutions, such as the government, are shifted onto individuals who cannot bear such responsibilities sustainably. In fact, a significant portion of the country can trace more of their success to the input of kinsmen than to any direct input from formal governance structures, which might be a foundational element of the problem.

This distorted social contract places an undue burden of governance on the helper, affording them some level of authority over the group. This deviates from the conventional principles of a fair social contract, wherein the government is designated the responsibility and authority over resources, decision-making, violence, and other pertinent aspects.

The inclination to rely on personal relationships instead of institutional structures hampers the adoption of a more structured and practical approach to social welfare and governance. Also, placing the burden of welfare on individuals shifts the focus from overarching principles to the whims of specific personalities. This is one of the reasons why our politics tends to be tainted with tribalism, as people who feel that they only have social contracts with their kinsmen are more likely to fight to have resources placed at the disposal of their kinsmen rather than a government. This phenomenon results from a failed transition from the monarchist era to the modern nation-state phase. The failure to establish strong institutions during this transition has perpetuated a system where individuals, rather than principles, hold disproportionate influence.

Comparatively, other parts of the world have avoided such issues by undergoing economic evolution. Europe’s shift from subsistence agriculture to industrialisation generated employment and brought forth technological advancement and improvement in commercial agriculture. This transition increased agricultural yields, ensuring a more stable food supply. Simultaneously, a more robust governance culture was developed in tandem with industrialisation. Responsive to societal needs, Progressive governance frameworks played a pivotal role in establishing formal social welfare systems.

Effective governance structures facilitated long-term planning, resource allocation, and the formulation of policies addressing the evolving challenges of an industrialised society. This process of economic evolution allowed Europe to avoid persisting in a situation reminiscent of the black tax stage. The availability of jobs and enhanced agricultural productivity contributed to overall economic growth, consequently alleviating financial burdens on individuals.

In contrast, Nigeria’s evolution has been characterised by low industrialisation, which has contributed little to employment and the agricultural process. Limited employment opportunities, coupled with high food inflation stemming from low agricultural yields, have resulted in a significant portion of the population grappling with poverty, with more than 100 million Nigerians being desperately poor.

To grasp the gravity of this situation, it’s crucial to recognise that most of Nigeria’s staples are only partially supplied by well-run commercial agricultural concerns that operate at scale. Staples like beef, garri, yam, pepper, palm oil, fish, and others, are predominantly sourced from subsistence or modestly scaled agricultural operations. Unlike well-established commercial agricultural enterprises that operate on a larger scale, these smaller ventures lack economies of scale that could result in lower unit prices for food items and generate employment for millions of Nigerians. Consequently, the millions of individuals associated with these smaller operations, who should have been supporting their families, find themselves unemployed and grappling with soaring food prices. They will not starve to death. They must be fed. Until we work out a better structure, we must do some form of ‘black tax’ to keep our society from total collapse. That is the reality of the situation.

Nwanze is lead partner at SBM Intelligence.

Disclaimer

The information in this article was curated from online sources. NewsWireNGR or its editorial team cannot independently verify all details.

Follow us on Instagram and Facebook for Live and Entertaining Updates.

Always visit NewsWireNGR for the latest Naija news and updated Naija breaking news.

NewsWireNGRLatest News in Nigeria

Send Us A Press Statement/News Tips on 9ja Happenings: [email protected].

Advertise With Us: [email protected]