Economy

North central zone stakeholders propose 35% revenue allocation to states, 26% for LGs

Majority of the states in the North central zone, on Thursday, proposed a 39: 35: 26 per cent revenue sharing formula for the three tiers of government in the country.

The States made their positions known at a one-day North Central Zonal public hearing on the review of the current Revenue Allocation Formula (RAF), organised by the Revenue Mobilization Allocation and Fiscal Commission (RMAFC), at Government House, Lokoja.

In his remarks, Gov. Yahaya Bello of Kogi, advocated a sharing formula of 39, 35 and 26 per cent between the Federal, States and Local Governments, respectively, in order to effect the desired development of the country.

Bello, who was represented by his Deputy, Edward Onoja, stated that the main objectives of revenue allocation was to promote national unity and accelerate the economic growth of all tiers of government.

He lamented that the current formula in use had failed to achieve the desired aspirations of the citizens for development.

“We can no longer deny that a comprehensive review of RAF currently in use in Nigeria had become overdue.

”Currently, the Federal Government takes 52.68 per cent, the 36 states and the FCT split 26.72 per cent and the local government councils make do with 20.60 per cent.

“The nine oil-producing states receive an additional 13 per cent as derivation revenue which is distributed among them depending on the actual contribution of each to crude oil receipts.

“Existential realities between the three tiers of government today necessitate a more equitable sharing plan for all revenues accruing into the federation account,” Bello said.

INTERESTING READ: My wife refused to swear with bible that she does not cheat, Man laments

He, therefore, urged the review committee to take a critical look at the revenue allocation formula currently in use with a view to do the needful in the interest of Nigerians.

The News Agency of Nigeria (NAN) reports that the representative of Plateau state proposed a 40, 35 and 25 per cent formula, while Nasarawa state advocated 44, 35 and 21 for the three tiers of government, respectively.

Also speaking, the Commissioner for Land, Survey and Solid Minerals, Mr Bernard Unenge, who made the presentation on behalf of the Benue state government, advocated 30, 45, and 25 per cent for federal, states and local governments, respectively.

On her part, the Kwara State Commissioner for Finance, Mrs Florence Oyeyemi, in a virtual presentation, advocated a 33, 30 and 27 per cent sharing formula, respectively.

Dr Joel Akowe, on behalf of the Academia, proposed 30, 35 and 20 per cent respectively, while proposing a 15 per cent allocation to a Special Fund.

The Representative of the Network of Kogi state Non-Governmental Organisations (KONGONET), Mr Muraina Idris, proposed 40, 27 and 33 per cent respectively, as he argued that this formula would enable the federating units and constituents to receive more attention in terms of development.

He added that over the years, the state governments had not really shown the need for increased resources as the community of civil society feels that a huge gap had existed between resource allocation and development, across majority of the federating units.

ALSO READ: #EndSARS: Lagos judicial panel’s report will be made public — Sanwo-Olu

Idris further said that their proposed allocation of 33 per cent to local governments, would reduce rural-urban migration, create employment, promote development in rural areas and improve security.

For the Vice President, National Council of Women Societies (NCWS), Kogi branch, representing women, the three tiers of government should receive allocations in the ratio of 30, 34 and 23 respectively, but that the 13 per cent derivation for oil-producing states be retained.

Mr Victor Ibrahim, who spoke on behalf of the Kogi Chamber of Commerce, Industry, Mines, and Agriculture (KOCCIMA), proposed 36, 33 and 26 per cent revenue formula, but on the condition Nigeria would practice true federalism.

Ibrahim said this had become necessary because the nation had been engaged in a unitary system of government, which had hindered development at the grassroots.

Mr Yahaya Ibrahim, the National Chairman, Persons Leaving With Disabilities (PLWDs), proposed 39, 29 and 32 per cent for the three tiers of government, respectively.

He specifically appealed to the Federal Government to, however, support the Kogi government, in its bid to empower the PLWD in the state.

The chairman cited Governor Yahaya Bello for commendation, for according PLWDs in the state priority in terms of inclusiveness in governance, empowerment, among others.

Earlier, in his address of welcome, the Chairman of RMAFC, Engr. Elias Mbam, said the commission had been empowered by the Constitution to review, from time to time, the RAF and principles in operation to ensure conformity with changing realities.

This was by virtue of Paragraph 32(b), Part 1 of the Third Schedule to the 1999 Constitution of the Federal Republic of Nigeria (As Amended), he said.

The chairman disclosed that for the review, additional relevant data had been collected from relevant government agencies, and studies on fiscal matters relating to revenue allocation had also been undertaken.

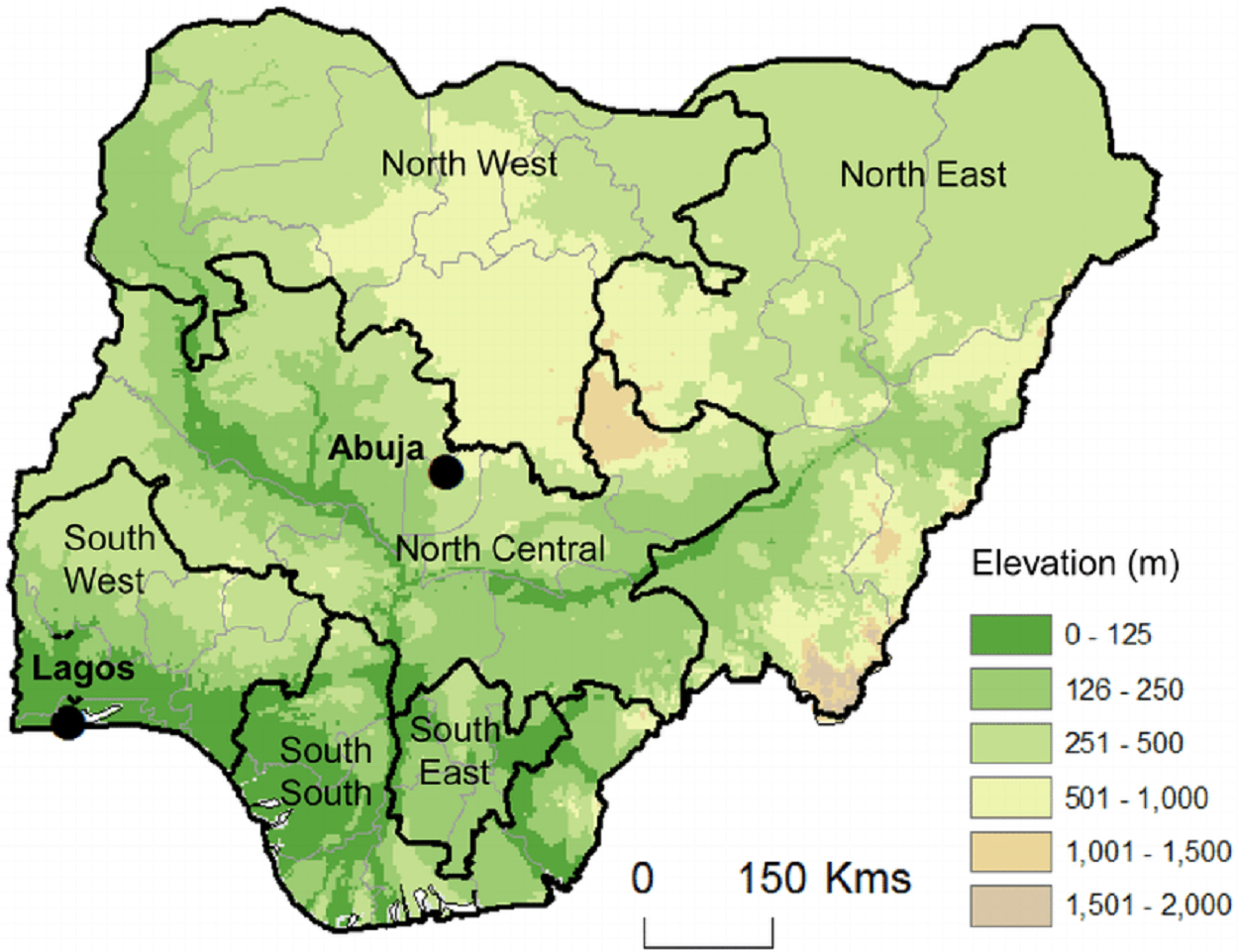

He said that the public hearing was the fourth in the series, as the commission had earlier undertaken similar exercises in the South-West, South-South and South-East Zones.

Mban said plans had also been concluded to conduct the hearing in the remaining two geo-political zones of the North-West and North-East.

“I wish to use this opportunity to invite all Nigerians to please participate and make contributions to this review process.

“It is our belief that your contributions will certainty enrich the process and ensure that the new revenue allocation formula reflects the wishes and aspirations of Nigerians”, Mbam said. (NAN)