Business

FG Targets N66bn Revenue From Imposed Stamp Duty On Bank Customers In 2016

The Federal Government is targeting an additional N66.1 billion revenue in 2016 from an imposed stamp duty of N50 on bank customers for money received into their accounts.

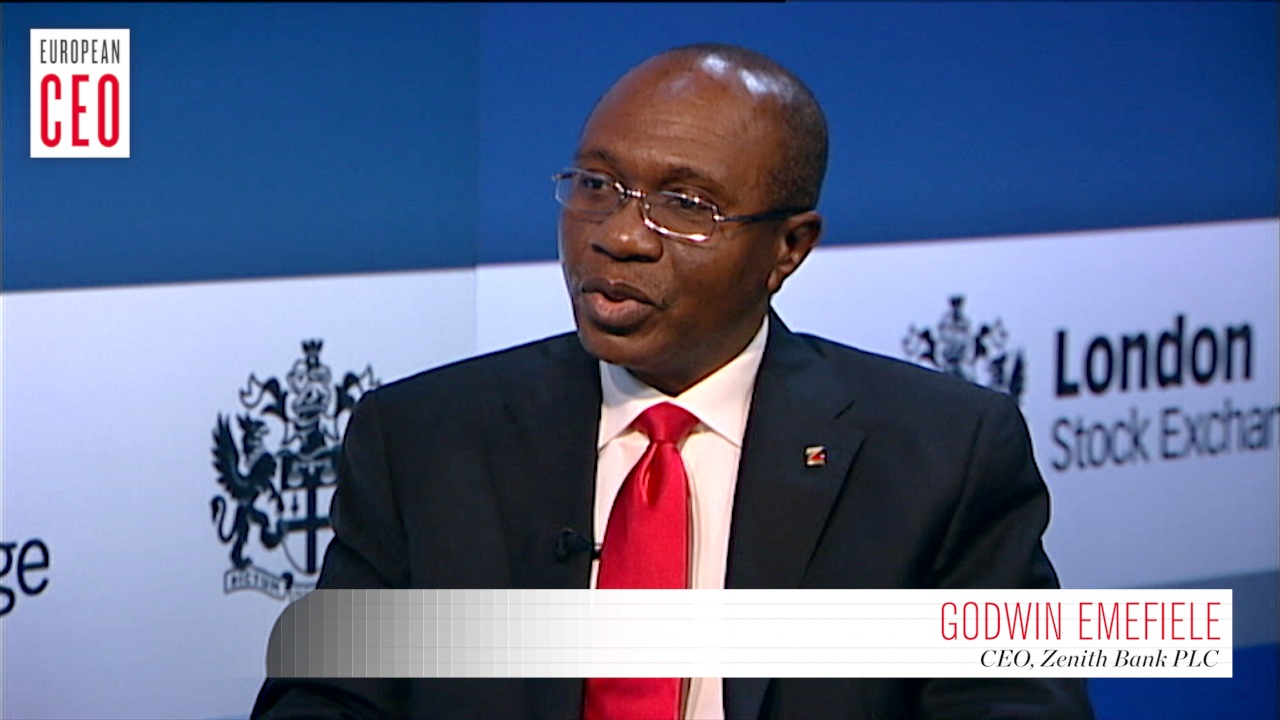

The Central Bank of Nigeria (CBN) Governor, Mr Godwin Emefiele, gave the indication while speaking with newsmen on the sideline of the Monetary Policy Meeting on Wednesday in Abuja.

NAN reports that the 2016, 2017, 2018 Medium Term Expenditure Framework and Fiscal Strategy Paper as captured in the 2016 Budget under the non-oil revenue section, shows that the Federal Government projects to make N66.1billion in 2017 from stamp duty alone.

It also projects that the revenue would grow to N71.8 billion in 2017 and to N78.5billion in 2018.

Emefiele said that the Federal Government was exploring opportunities in the banking sector as part of efforts to boost its revenue base through taxes and rates.

“There are currently various options the government and the economic team are looking at as ways to boost non-oil revenues and stamp duty is one option.

“The numbers are there in the budget about what we expect to generate from stamp duties in 2016.

“We will try as much as possible, working with the banks to ensure that all transactions are captured in a way that ensures that for transactions above N1,000 and above, each of those transactions get debited for N50.

“We have not dimensioned it yet; I believe in due course, Nigerians will begin to know what this will translate into.

“But we believe that it will help the efforts of the government in improving its revenue.’’

The News Agency of Nigeria (NAN) recalls that the CBN had recently reintroduced the policy, as contained in the Stamp Duty Act, 2004.

The banks have since been directed to collect the duty from their customers and remit it to the Nigerian Postal Service Account at the CBN.

The charge is on all transactions by a bank or financial institution in respect of deposits and transfers worth N1,000 and above.

However, it doesn’t not apply to self to self-transactions whether intra or interbank and it also exempts transfers and withdrawals involving salary accounts and savings accounts, used by majority of low income Nigerians.

Emefiele said that looking at the dwindling revenue from oil, the federal government was now determined to enforce all financial laws and regulations in order to shore up revenue prevent leakages.

The CBN governor noted that the economy is improving as a result of the 41 items CBN banned from receiving foreign exchange in the Nigerian foreign exchange market.

NAN also recalls that in June 2015, CBN restricted the access of foreign exchange to importers that deal with items such as rice, palm oil, meat, vegetables, poultry, fish, toothpick and textiles and among others.

He noted that since the ban, local production of some of these items had improved, showing that the ban had tremendous impact on local businesses.

“I am happy to say that the impact has been profoundly positive because if Nigerians recall that before that policy, Nigerian businesses were importing 20 million eggs daily from outside the country.

“Nigerian businesses were importing tomatoes and lettuce from outside the country.

“Nigerian businesses were importing all these items that we should be producing locally even including fish.

“The Nigerian coastal waters stretch almost close to 500 kilometres.

“There are countries today in the world that do not have the type of opportunities that we have yet with the little size of coastal waters that they have, they use fish and export fish to Nigeria.

“There are countries today, who are just oil producing countries with a population less than some of our states.

“When there was oil boom those countries’ economy invested proceeds of their oil in sovereign funds and they’d exported their fish to Nigeria.

“I think it is time we started to look inwards to say, for instance, some of these items we need to grow them locally.

“If you ask people they will you how the demand for their products has been stimulated as the result of the ban of these items.’’