Business

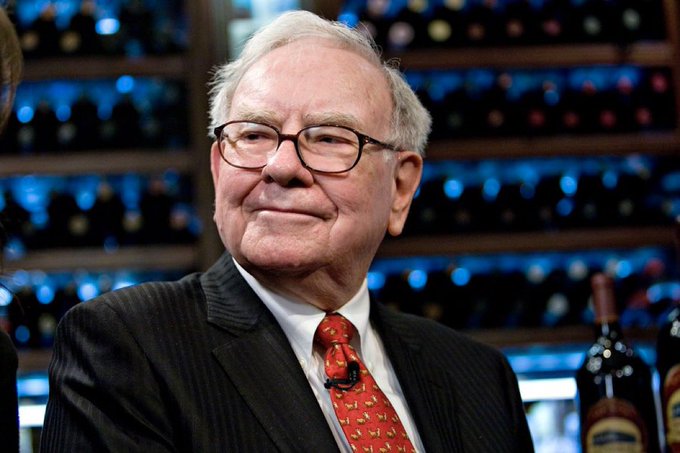

Top investment lessons that we can learn from renowned investor and billionaire, Warren Buffett

Warren Buffett, the renowned investor and billionaire, has achieved legendary status in the world of finance. His investment strategies, disciplined approach, and long-term thinking have made him one of the most successful investors of all time. In this article, we will explore the top investment lessons that we can learn from Warren Buffett, drawing insights from his decades of investing experience.

- Invest in What You Understand: Buffett emphasizes the importance of investing in businesses and industries that you can comprehend. Stick to your circle of competence and avoid venturing into unfamiliar territory.

- Long-Term Perspective: Buffett is known for his patient approach to investing. He believes in holding investments for the long term, focusing on the intrinsic value of a company rather than short-term market fluctuations.

- Value Investing: Buffett is a staunch advocate of value investing. Look for companies with solid fundamentals, strong competitive advantages, and attractive valuations. Buy stocks when they are undervalued and hold them until their true value is realized.

- Margin of Safety: Invest with a margin of safety by buying stocks at a significant discount to their intrinsic value. This provides a cushion against potential losses and allows for potential upside when the market corrects itself.

- Ignore Market Noise: Buffett advises investors to ignore short-term market noise and focus on the long-term prospects of a company. Tune out the daily fluctuations and invest based on the underlying fundamentals.

- Patience Pays Off: Buffett’s success is a testament to the power of patience. Be willing to wait for the right opportunities to arise and avoid making impulsive investment decisions based on market sentiment.

- Diversification: While Buffett believes in focusing on a few high-quality investments, he also emphasizes the importance of diversification. Spread your investments across different asset classes and industries to reduce risk.

- Invest in Quality Companies: Buffett seeks out companies with strong competitive advantages, sustainable business models, and excellent management teams. Look for companies with a track record of profitability and a durable competitive edge.

- Avoid Overpaying: Never overpay for a stock, no matter how promising the company may seem. A good investment can turn into a poor one if the price paid is too high.

- Cash is a Valuable Asset: Maintain a cash reserve for opportunities that arise during market downturns. Having cash on hand allows you to take advantage of undervalued investments when others are forced to sell.

- Embrace Contrarian Thinking: Be willing to go against the crowd and invest in assets that others are avoiding. The best opportunities often lie where others fear to tread.

- Focus on the Business, Not the Ticker: Buffett advises investors to focus on the underlying business rather than the stock price. Understand the company’s competitive position, cash flow generation, and long-term growth prospects.

- Be Greedy When Others Are Fearful: Buffett famously said, “Be fearful when others are greedy and greedy when others are fearful.” When markets are in turmoil, it can present excellent opportunities to buy quality stocks at discounted prices.

- Learn from Mistakes: Buffett acknowledges that making mistakes is part of the investment process. Learn from your failures, analyze what went wrong, and adjust your strategy accordingly.

- Invest in Yourself: Buffett emphasizes the importance of continuous learning and self-improvement. Invest in your own education, expand your knowledge, and stay informed about the companies and industries you invest in.

- Emotional Discipline: Maintain emotional discipline and avoid making impulsive investment decisions based on fear or greed. Stick to your investment plan and avoid letting emotions drive your actions.

- Avoid Timing the Market: Buffett advises against trying to time the market. Instead, focus on buying quality investments at attractive prices and hold them.