Business

In 24 Hours, Nigeria’s Reserves Fall By $92million

The new year begins with Nigerian forex stock falling by $91,571,740 in 24 hours.

The $91.6 million fall in Nigeria’s reserves is about the biggest decline since the Central Bank of Nigeria (CBN) implemented the use of bank verification number (BVN) in forex trading.

According to the latest figures from the CBN, the reserves closed year 2015 at $29,069,779,152 and opened in 2016 at $28,978,207,412, losing approximately $92 million in one trading day.

The interbank foreign exchange market was closed by the CBN on December 21, 2015 to conserve forex for an opening on January 4, 2016, leaving the parallel market as the only source of forex through the festive period.

In its plans for 2016, the CBN, in a bid to curb speculation and forex scarcity, outlined a new guideline for forex trading on the parallel market.

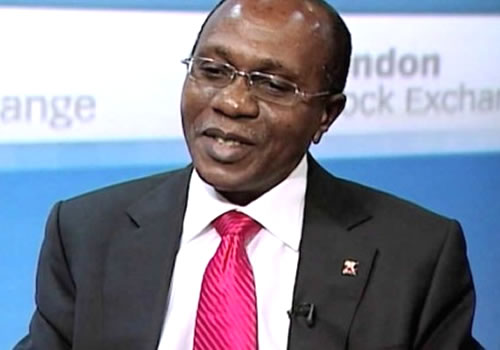

President Muhammadu Buhari and Godwin Emefiele, the CBN governor, have insisted on not devaluing the naira in the face of constant decline of the foreign reserves.

Christine Lagarde, the managing director of the International Monetary Fund (IMF), in Abuja on Tuesday, urged the federal government to consider being flexible with its monetary policy in order not to deplete the reserves.

“We believe that with very clear primary ambition to support the poorer people of Nigeria, there could be added flexibility in the monetary policy, particularly if as we think, the price of oil is likely to be low for longer,” Lagarde said.

“The occurrences should not deplete the reserves of the country, simply because of being seemingly rigid. I’m not suggesting that rigidity be totally removed, but some form of flexibility would help.”

A nation’s foreign reserves are usually an indication of the health of its international trade, with import-dependent countries often disadvantaged in their current account balance as a result of forex expenditure outstripping income.