Breaking News

Central Bank of Nigeria has directed all deposit money banks in the country to restructure

The Central Bank of Nigeria (CBN) has directed banks to restructure loan terms and tenors to households and businesses affected by the coronavirus outbreak.

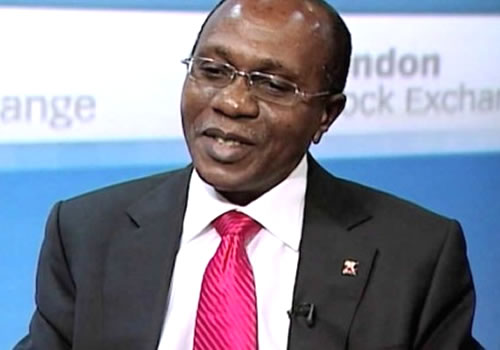

Addressing journalists in Abuja on Monday, Godwin Emefiele, the CBN governor, said the interest rate of its intervention programmes has been cut to 5% from 9%.

“The CBN hereby grants all deposit money banks leave to consider temporary and time-limited restructuring of the tenor and loan terms for businesses and households most affected by the outbreak of Covid-19 particularly oil & gas, agriculture, and manufacturing,” he said.

“The CBN would work closely with DMBs to ensure that the use of this forbearance is targeted, transparent and temporary, whilst maintaining individual DMB’s financial strength and overall financial stability of the system.”

The apex bank announced five policies in total.

The CBN said beneficiaries of its intervention facilities have been granted an additional one-year moratorium on principal repayments effective March 1, 2020.

“This means that any intervention loan currently under moratorium is hereby granted an additional period of one year,” Emefiele said.

A moratorium is the delay period which is given before the payment of a loan.

“Interest rates on all applicable CBN intervention facilities are hereby reduced from 9 to 5% per annum for 1 year effective March 1, 2020.”

The apex bank said it has created a N50 billion credit facility for small and medium-sized businesses that have been affected by the coronavirus outbreak.